25+ maximum dti for mortgage

Get the Right Housing Loan for Your Needs. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Kaelan Cheatham Nmls 1866424 San Antonio Tx

Web For example lets say you want to purchase a home for 750000.

. Web If the lender requires a debt-to-income ratio of 2836 then to qualify a borrower for a mortgage the lender would go through the following process to determine what expense. Ad Explore Quotes from Top Lenders All in One Place. Your lender will also look at your total debts.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Debt can be harder to manage if your DTI ratio falls between. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

Compare Offers Side by Side with LendingTree. Web DTI ratio examples Say your monthly gross income is 7000 and your housing expenses are 1800. Lock Your Rate Today.

Web Maximum DTI by type of loan Your lenders maximum DTI limit will depend partly on the type of loan you choose. Get Started Now With Quicken Loans. Web When applying for a home loan your debt-to-income ratio DTI is a deciding factor for approval.

Web Meanwhile Fannie Mae says for manually underwritten loans the maximum total DTI ratio for mortgages is 36 of the borrowers stable monthly income. Begin Your Loan Search Right Here. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

As a rule of thumb you want to aim for a debt-to. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

Get Instantly Matched With Your Ideal Mortgage Lender. Web The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50. Web Whats an Ideal Debt-to-Income Ratio for a Mortgage.

Some lenders may accept a debt-to-income ratio of. Ad Connect With A Loan Officer Today. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Ask Us Your Questions to Find Out Today. Start Our Online Application. Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for.

Check Your Eligibility and Connect With Our VA Loan Team for a Free Consultation Today. Ad Compare Mortgage Options Get Quotes. Up to 43 typically allowed.

And lenders get to set their own maximums too. Is a Reverse Mortgage Right for You. You plan to put 25 down 187500 which means the loan amount you need is 562500.

Ad Calculate the monthly and total payments of a mortgage. Ideally lenders prefer a debt-to-income ratio lower. Ad Compare the Best House Loans for March 2023.

What More Could You Need. Your front-end or household ratio would be 1800 7000 026 or 26. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

Get Started Now With Quicken Loans. - SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower. Web Different mortgage programs have different DTI requirements.

Web While many lenders require a DTI of no more than 43 some lenders including Better Mortgage can provide mortgages to borrowers with DTIs up to 50. Apply Get Pre-Approved Today. Ad Get Personal Attention and Support From a Leader in Government-Backed Mortgage Lending.

What More Could You Need. Web As a general rule your debt-to-income ratio should remain below 36 with no more than 28 of your income going toward mortgage-related expenses. Ad Compare Mortgage Options Get Quotes.

A VA loan a government home loan backed by the Department of. Bank Home Loan Officer To Support Your Conventional Loan Journey.

Getting A Mortgage With High Debt To Income Ratio Quontic

Bargain Pages Midlands 25th October 2013 By Loot Issuu

Mortgage With High Debt To Income Ratio

Calculating Your Debt To Income Ratio

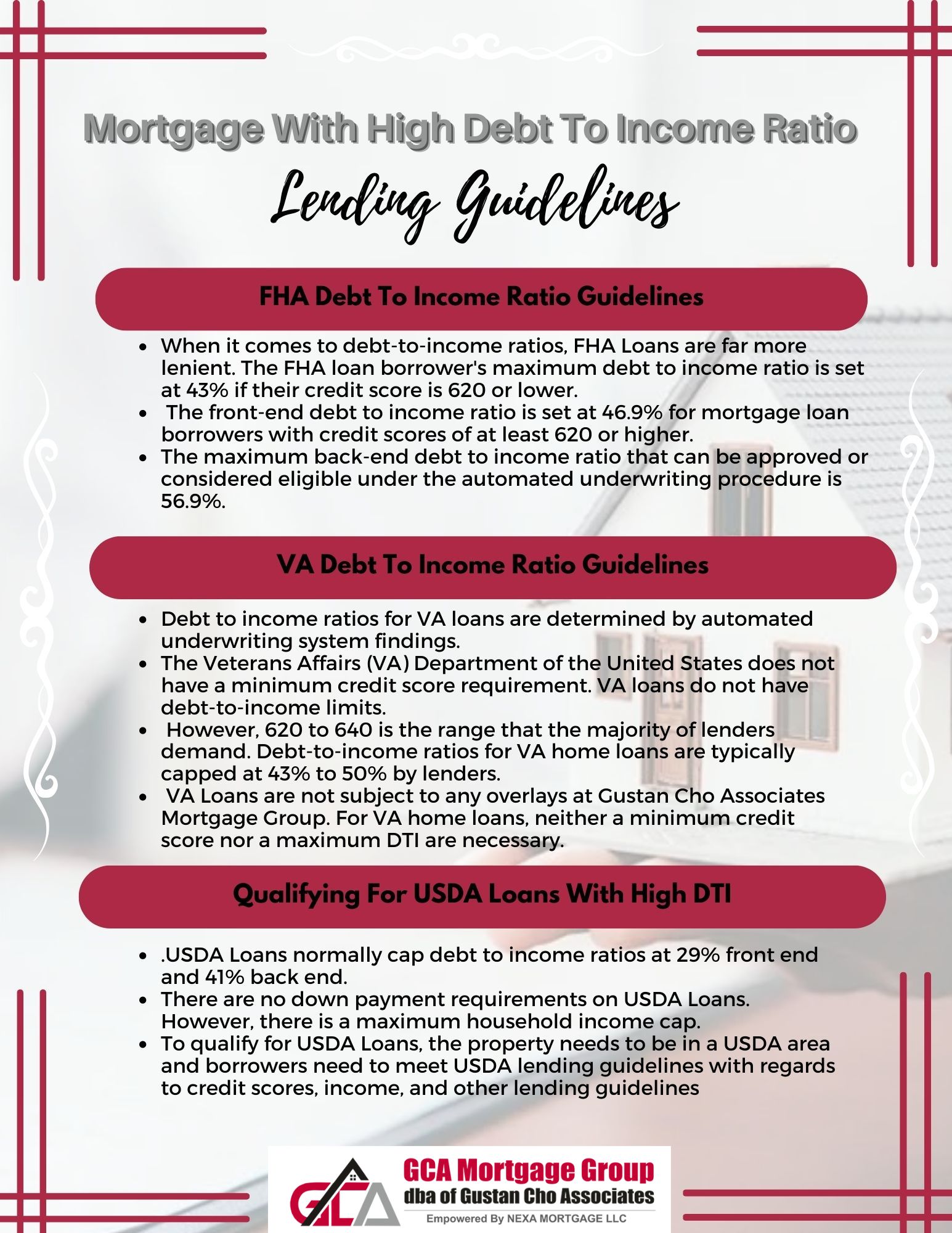

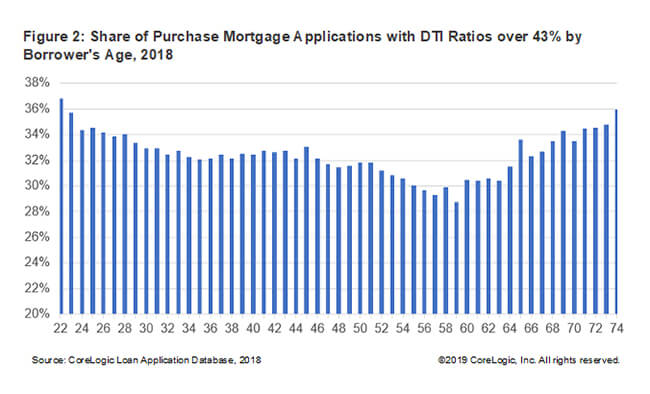

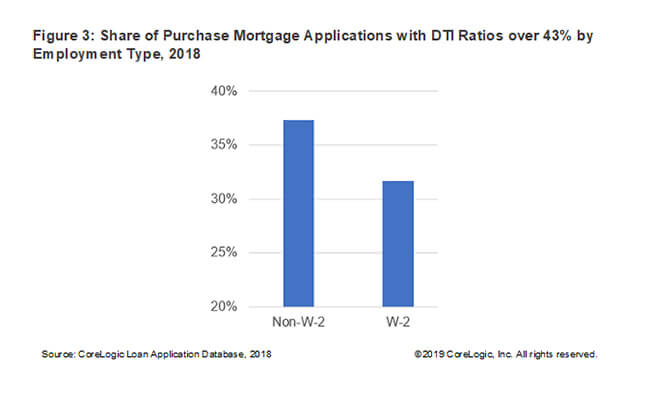

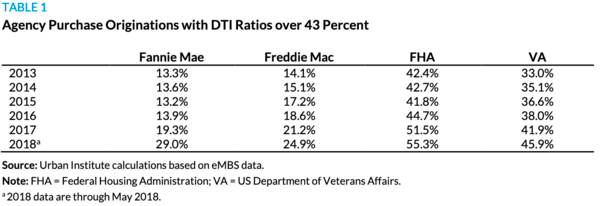

Expiration Of The Cfpb S Qualified Mortgage Gse Patch Part 2 Corelogic

Debt To Income Ratio Limit To Qualify For Mortgage Loan

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

What Is Debt To Income Dti Ratio Discover Personal Loans

Dylan Langei Mba Branch Manager Sr Loan Officer Evergreen Home Loans Nmls 3182 Linkedin

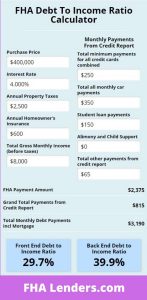

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

Debt To Income Ratio Limit To Qualify For Mortgage Loan

Expiration Of The Cfpb S Qualified Mortgage Gse Patch Part 2 Corelogic

Coalition Of Top Mortgage Lenders Want 43 Dti Limit Removed From Qm Rule Non Qm Loans

Kaelan Cheatham Nmls 1866424 San Antonio Tx

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

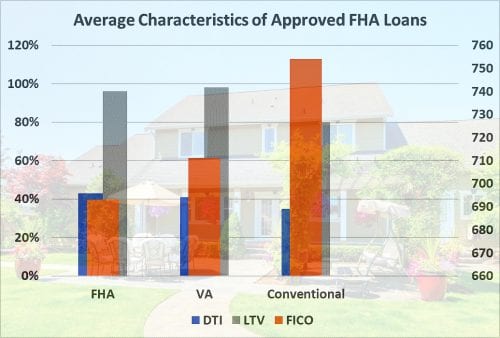

Guide To Fha Home Loans How Much Income Do You Need Mortgage Rates Mortgage News And Strategy The Mortgage Reports